|

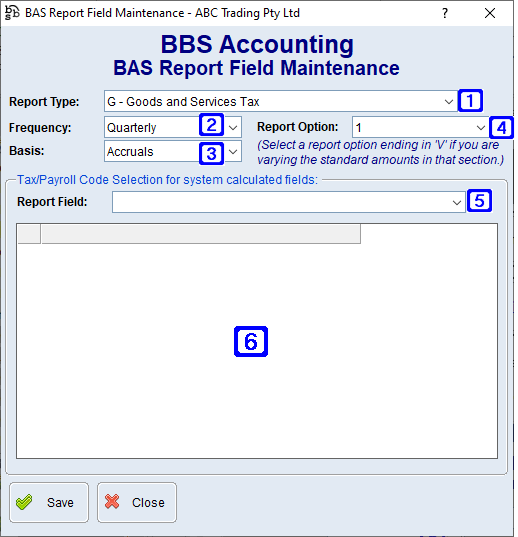

Main Menu > General Ledger > Maintenance > GST/BAS > BAS Report Field Maintenance |

The BAS Report Field Maintenance program is where the basic settings for the BAS and IAS for a company is set up. This includes the frequency for each BAS report type (eg monthly or quarterly), the basis for reporting (eg Cash or Accruals) and the reporting options. The fields in this screen should be left as the defaults and should not be changed unless advised by the ATO or BBS, for example if the ATO were to change your submission frequency then it would need to be changed in BBS. If this happens please contact support@bbsoftware.com.au with the details so we can assist.

BAS Report Field Maintenance Screen

|

Report Type: •F - Fringe Benefits Tax - Will display the reporting information for Fringe Benefits Tax setup in your system •G - Goods and Services Tax - Will display the reporting information for Goods and Services Tax setup in your system •T - PAYG Company Income Tax Instalments - Will display the reporting information for PAYG Company Income Tax Instalments setup in your system •W - PAYG Withheld - Will display the reporting information for PAYG Withheld setup in your system •Z - BAS Summary - Will display the reporting information for the BAS Summary section in your system |

|

Frequency: •Monthly - The selected report type is reported on monthly •Quarterly - The selected report type is reported on quarterly •Annually - The selected report type is reported on annually |

|

Basis: •Accruals - Your reporting method is based on Accruals (revenue and expenses are recorded when you receive a bill or raise an invoice) •Cash - Your reporting method is based on Cash (revenue and expenses are recorded when they are paid) |

|

Report Options for F - Fringe Benefits Tax: •1 - ATO provided instalment amount •1V - Varied ATO provided instalment amount

Report Options for G - Goods and Services Tax: •1 - Calculate GST and Report Monthly or Quarterly •2 - Calculate GST Monthly or Quarterly and Report Annually •3 - ATO Provided GST Instalment Amount

Report Options for T - PAYG Company Income Tax Instalment: •1 - ATO provided instalment amount calculated from your latest tax return •1V - Varied ATO provided instalment amount calculated from your latest tax return •2 - Calculate instalment amount using instalment income multiplied by ATO provided % rate |

|

Report Fields for G - Goods and Services Tax •G01 - Total Sales (including GST) - Will display the tax codes in the list box below included in the calculation of the figure to be reported at G01 - Total Sales (including GST) on your BAS •G02 - Export Sales - Will display the tax codes in the list box below included in the calculation of the figure to be reported at G02 - Export Sales on your BAS •G03 - Other GST-Free Sales - Will display the tax codes in the list box below included in the calculation of the figure to be reported at G03 - Other GST-Free Sales on your BAS •G04 - Input Taxed Sales - Will display the tax codes in the list box below included in the calculation of the figure to be reported at G04 - Input Taxed Sales on your BAS •G10 - Capital Purchases (including GST) - Will display the tax codes in the list box below included in the calculation of the figure to be reported at G10 - Capital Purchases (including GST) on your BAS •G11 - Non-Capital Purchases (including GST) - Will display the tax codes in the list box below included in the calculation of the figure to be reported at G11 - Non-Capital Purchases (including GST) on your BAS

Report Fields for W - PAYG Tax Withheld - Not Applicable. |

|

Will display with a tick box the tax codes that are included in the calculations for the selected report field. |