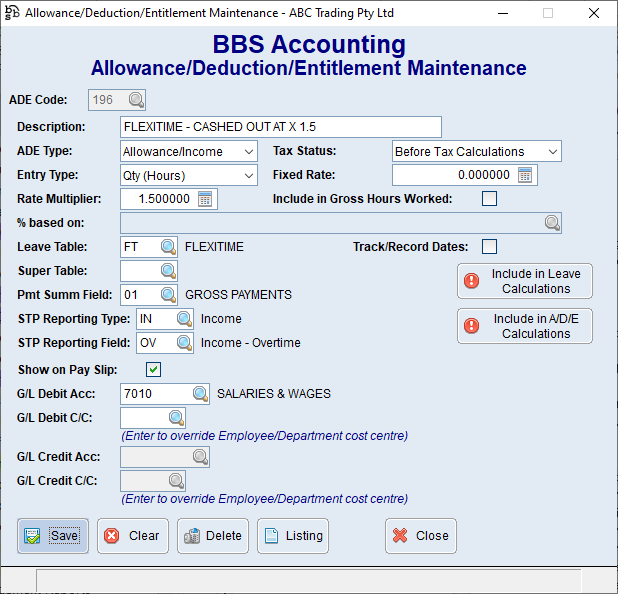

As per the Australian Taxation Office, a cash out of TOIL must be treated as overtime. Below is how to setup and use the A/D/E code.

TOIL - Some awards and registered agreements allow an employee to take paid time off during the ordinary span of hours instead of being paid overtime pay: time off in lieu (TOIL). If the absence is not taken, the employee may request that the accrued time be paid out at the overtime rates. The cash out of TOIL in service should be reported as Payment Type – Overtime. TOIL absence taken is other paid leave (Other Paid Leave (O)) and unused TOIL paid out on termination is an ETP (Employment Termination Payments (ETPs)).

No superannuation or leave should be calculated as it is just the overtime the employee should have been paid.