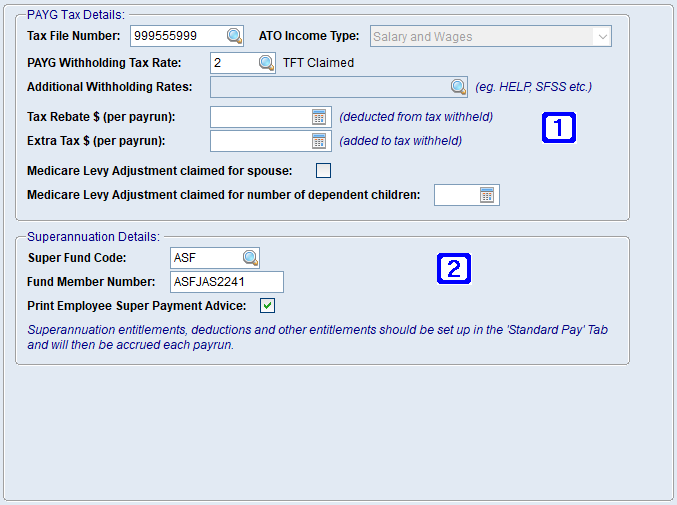

The PAYG Tax & Superannuation tab contains tax and superannuation information.

Employee Masterfile Maintenance - PAYG Tax & Superannuation Tab Screen

|

Tax File Number - Enter the employees tax file number. ATO Income Type - Select the ATO Income Type by clicking the drop down arrow. Please refer to ATO Coding Definitions - Payroll for more information. PAYG Withholding Tax Rate - Select the PAYG withholding tax rate by clicking the search button. Additional Withholding Rates - Select additional withholding rates by clicking the search button. Tax Rebate $ (per payrun) - If the employee is eligible for a tax rebate, the value can be entered here to be deducted from the tax withheld each pay period . Extra Tax $ (per payrun) - If the employee wishes to pay extra tax each pay period, the value can be entered here. Medicare Levy Adjustment claimed for spouse - If the employee is eligible for a Medicare Levy Adjustment for their spouse and have completed a Medicare levy variation declaration this box will need to be ticked. Medicare Levy Adjustment claimed for number of dependent children - If the employee is eligible for a Medicare Levy Adjustment and have completed a Medicare levy variation declaration, enter the number of dependent children as per the declaration. |

|

Super Fund Code - Enter the employees super fund code or click the search button. Fund Member Number - Enter the employees superannuation fund member number. Print Employee Super Payment Advice - For future use. |