|

Main Menu > Creditors > Post Stock Receipt Invoices |

Stock receipted through the Stock Receipting program is recorded against the Supplier Invoice or Delivery Docket number and is stored in the accounts payable system ready to be posted against the creditor.

Entering Invoices for Delivery Docket Received Goods

Entering Invoices for Delivery Docket Received Goods

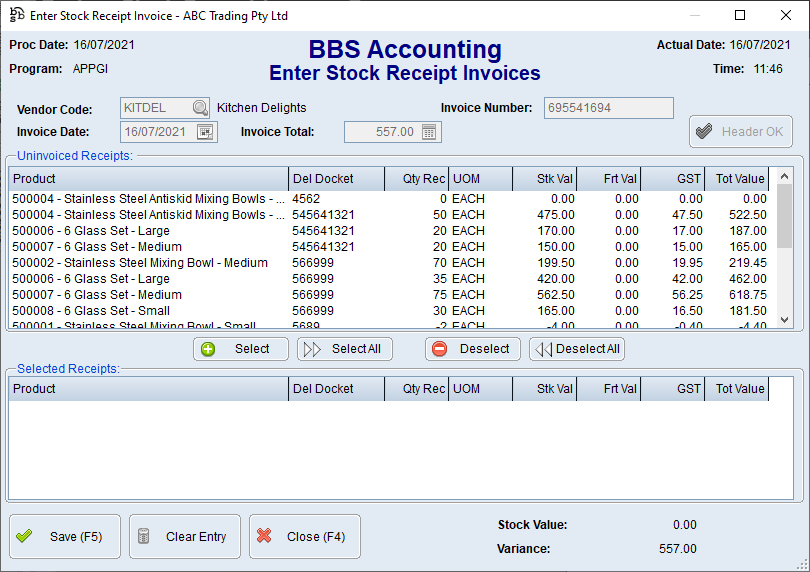

Once an invoice arrives for goods that have been received by a delivery docket, the invoice detail can then be entered and the stock receipt line items that apply to the invoice are matched against it. This is done by clicking the ‘Enter Invoices for Delivery Docket Receipted Goods’ button on the Post Stock Receipt Invoices screen.

The user enters the vendor code, invoice number, invoice date and total value of the invoice including freight and GST. Users then selects any of the uninvoiced receipt entries from the top list box that apply to this invoice. A variance is displayed at the bottom as with stock receipted directly against an invoice. Clicking Save will save the entry and move it to the Post Stock Receipt Invoices screen for posting to creditors. The invoice number will also be amended on all purchasing history records and stock movements to enable easy traceability of receipts from within the inventory system.

The Goods Received without Invoice report can be run to see a list of stock receipts not yet matched to creditors invoices. This report can be used to chase suppliers for missing invoices. For accounting purposes, this should balance to your Purchases Receipts Clearing account (if using the Inventory Control - General Ledger interface) and is considered your ‘Purchase Accruals’ for end of month / end of financial year purposes. |

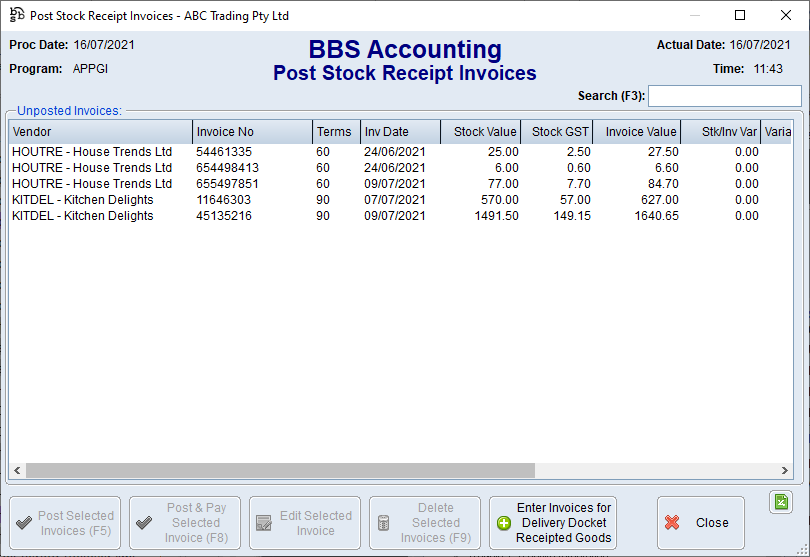

Any supplier invoices entered through the Stock Receipting program will be displayed in the Post Stock Receipt Invoices screen enabling a final check on the invoice details prior to posting including the invoice number, invoice date and total value that was entered when receipting the stock.

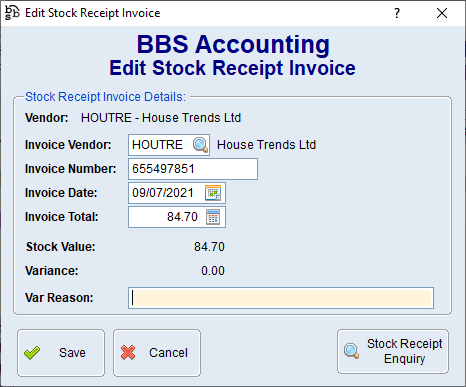

An entry can be edited by double clicking on it or highlighting it and clicking ‘Edit Selected Invoice’.

To post an invoice, or several invoices to the accounts payable system, a user can highlight them and click Post Selected Invoices. If an invoice has already been paid by cheque, EFT or credit card, users can highlight it and click ‘Post & Pay Selected Invoice’ and enter the relevant payment information.

If an invoice was entered completely in error, it can be deleted, however this will place the receipted items onto the ‘Delivery Docket Received Goods’ screen (see below).

As with all creditors invoices, they can be edited after they are entered providing there are no payment records applied to them. For this reason it is recommended that invoices be posted from this screen and edited as required in the Creditors Invoice Entry screen (with the exception of the vendor, invoice number, date and total which can be edited prior to posting).

The Post Stock Receipt Invoices program can also be accessed from within Creditors Invoice Entry by clicking the ‘Import Stock Receipt Invoices’ button.

Once all posting is complete, users will be asked to update the batch of creditors invoices. If this screen was accessed through Creditors Invoice Entry, the posted stock receipt invoices will be added to the open batch of creditors invoices.

PLEASE NOTE: The invoice total entered on the Stock Receipting screen, that can also be edited on this screen, is the invoice total that is posted to creditors. This ensures that you are always paying the correct amount regardless of the value of stock that has been received. The Stk/Inv Variance is taken up as a Purchase Price Variance and the balance is sent to your stock or purchases receipts clearing account. A large variance may indicate a problem with the stock that was received and should be investigated. |