|

Main Menu > Payroll > Maintenance > Allow/Deduct/Entitle Maintenance |

The Allow/Deduct/Entitle Maintenance program can be used to create and maintain payroll allowance, deduction and entitlement codes within your organisation.

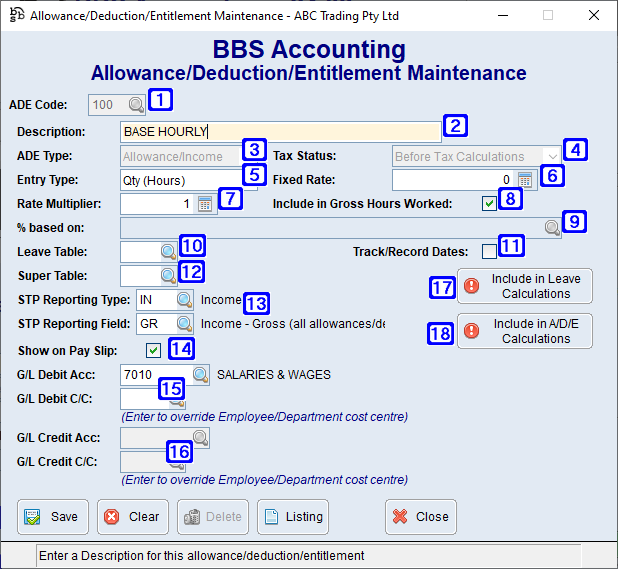

Allowance/Deduction/Entitlement Maintenance Screen

|

ADE Code - The ADE code or click |

|

Description – The description of the ADE code. |

|

ADE Type: •Allowance/Income - The selected ADE code is an allowance/income code. •Deduction - The selected ADE code is a deduction code. •Entitlement/Other - The selected ADE code is an entitlement code |

|

Tax Status: •Before Tax Calculations - The selected ADE code will be added to the employees gross pay where tax will be deducted from the selected ADE code. •After Tax Calculations - The selected ADE code will be added to the employees net pay where tax will not be deducted from the selected ADE code. |

|

Entry Type: •Qty (Hours) - The selected ADE code is based on hours. •Value (Variable) - The selected ADE code will be a variable value. •Value (Fixed) - The selected ADE code will be a fixed value. •Percentage of - The selected ADE code will be a nominated percentage of other ADE codes selected. |

|

Fixed Rate/Value/Percentage - The hourly rate where Qty (Hours) is selected, the value where Value (Variable) and Value (Fixed) is selected and the percentage where Percentage of is selected. |

|

Rate Multiplier - The rate the selected ADE code will multiply the employees hourly rate by or the fixed rate that has been entered into the Fixed Rate field. ie. Time and a half = 1.5, Double Time = 2.0 etc (Only applicable when Qty(Hours) has been selected as the entry type). |

|

Include in Gross Hours Worked - Will include the selected ADE code in the employees gross hours worked. This should be unticked for ADE codes such as Overtime. |

|

% based on - The ADE code/s or click |

|

Leave Table - The leave table code or click |

|

Track/Record Dates - When ticked users will be required to enter start and end dates for when the selected ADE code is entered onto an employees pay. |

|

Super Table - The super table code or click |

|

STP Reporting Type - The STP Reporting Type or click STP Reporting Field - The STP Reporting Field or click |

|

Show on Pay Slip - When ticked the selected ADE code will display on the employees payslip. |

|

G/L Debit Acc - The general ledger debit account number the selected ADE code will be posted to. G/L Debit C/C - The cost centre if you wish to override the Employee/Department cost centre. |

|

G/L Credit Acc - The general ledger credit account number the selected ADE code will be posted to. G/L Credit C/C - The cost centre if you wish to to override the Employee/Department cost centre. |

|

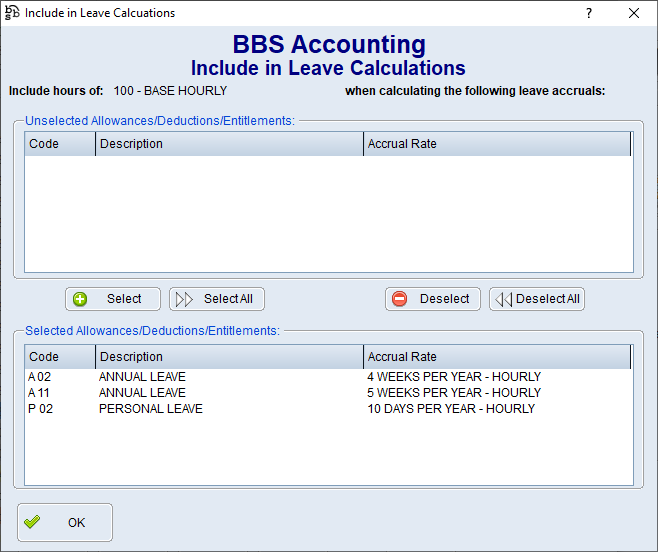

Include in Leave Calculations - The selected ADE code will be included when calculating the selected leave. Please refer to Include in Leave Calculations for more information. |

|

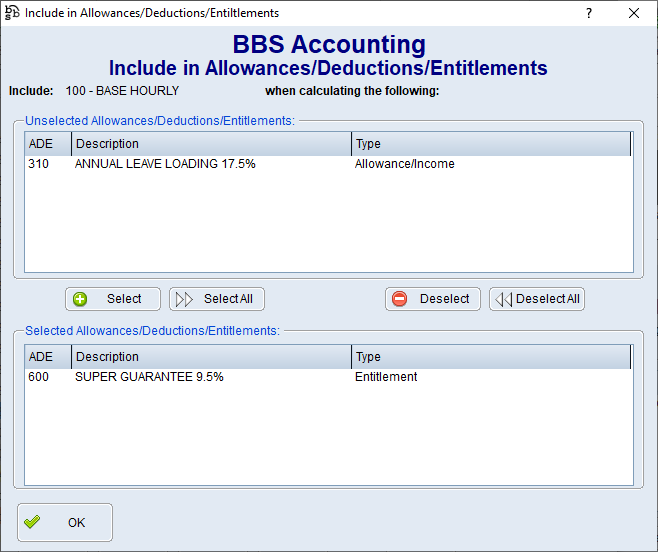

Include in A/D/E Calculations - The selected ADE code will be included when calculating the selected allowances/deductions/entitlements. Please refer to Include in A/D/E Calculations for more information. |

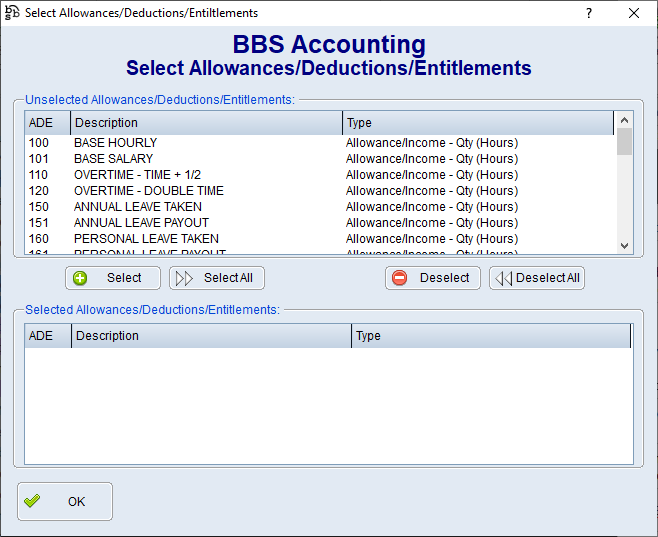

Select Allowances/Deductions/Entitlements

Select Allowances/Deductions/Entitlements

to search.

to search.