|

Main Menu > Banking > Cash Book > Cash Book Journal Enquiry |

The Cash Book Journal enquiry program allows users with access to view cash book journals.

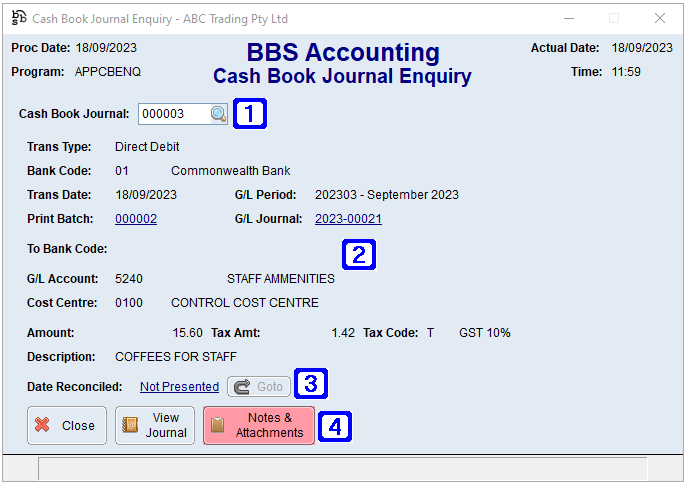

Cash Book Journal Enquiry Screen

|

Cash Book Journal - The cash book journal number (if known) or click

|

|

Trans Type - Displays the transaction type of the selected transaction. Bank Code - Displays the bank code the selected transaction relates to. Trans Date - Displays the transaction date of the selected transaction. G/L Period - Displays the general ledger period the selected transaction was updated in. Print Batch - Displays the print batch number for the selected transaction. G/L Journal - Displays the general ledger journal number for the selected transaction. To Bank Code - Displays the bank code to which funds were transferred to (for bank transfers only) G/L Account - Displays the general ledger account the selected transaction was posted to (for direct debits and direct credits only). Cost Centre - Displays the cost centre the selected transaction was posted to (for direct debits and direct credits only). Amount - Displays the amount of the selected transaction. Tax Amt - Displays the tax component of the selected transaction (for direct debits and direct credits only). Tax Code - Displays the tax code relevant to the selected transaction (for direct debits and direct credits only). Description - Displays the description of the selected transaction. |

|

Date Reconciled - The date the selected cash book transaction was reconciled. Where the transaction is yet to be reconciled Not Presented will be displayed. Goto - Navigates users to Bank Statement Enquiry if the selected cash book journal has been reconciled. |

|

View Journal - Navigates users to Journal Enquiry for the selected cash book journal. Notes & Attachments - Allows users to add/or view any Notes & Attachments that may be attached to the cash book journal entry. Please refer to General Ledger Notes & Attachments for more information. |

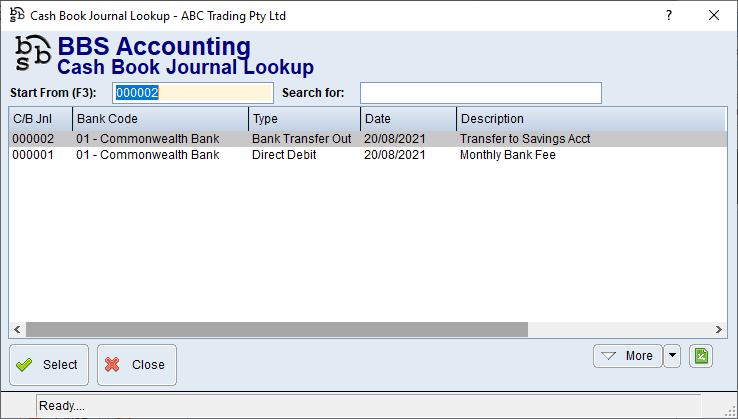

to search. The below pop up will appear for users to select the relevant cash book journal.

to search. The below pop up will appear for users to select the relevant cash book journal.