Overseas Import Shipments can be created in Overseas Import Shipment Entry/Maintenance. This is usually performed once the Bill of Landing or Packing Lists are received and the quantities coming in the shipment have been confirmed. Overseas Import Shipments have a unique number which is generated by BBS using the next available number in the sequence. To create a new order click the New Overseas Import Shipment button in Overseas Import Shipment Entry/Maintenance.

Enter the Vendor code for the selected shipment (ie the vendor supplying the goods). Note: Only one vendor per shipment. (if goods from multiple Vendors are being sent via the same shipment, users will need to create different shipments and apportion the import costs across the vendors manually).

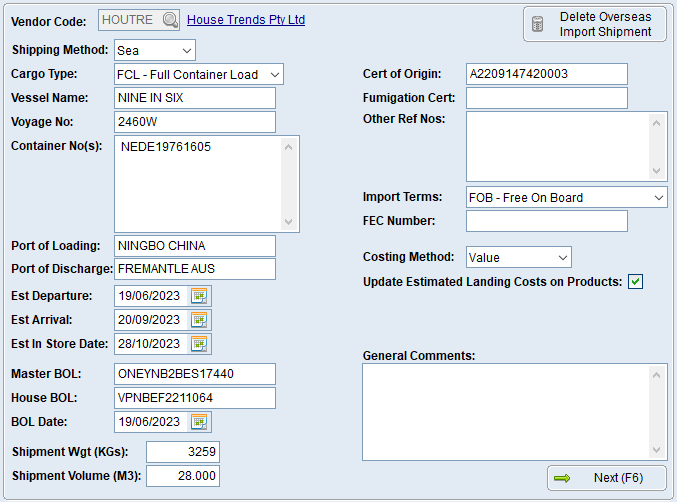

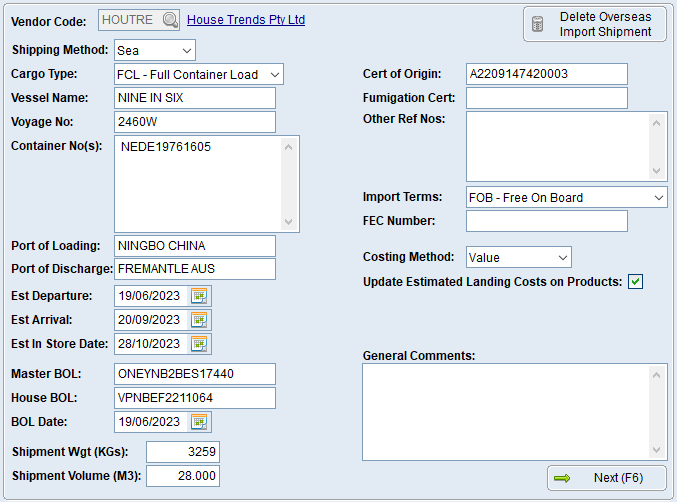

Shipment Details Tab Shipment Details Tab

Shipment Details tab - Enter the relevant data. Most of the fields aren't mandatory as they are only storing data. The important information to enter is:

•Est In Store Date – this date will be used to update all the ETAs on the purchase order lines selected on this shipment.

•Costing Method – the method used to apportion import costs across the goods received – either by their value, weight or volume.

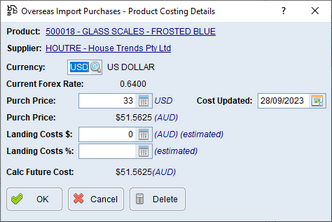

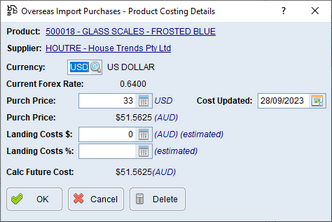

•Update Estimated Landing Costs on Products – when ticked, once the stock has been receipted, the calculated landing costs including duty, import costs and customs charges will be updated as the Landing Costs $ value on the Overseas Import Purchases - Product Costing Details screen which will in turn affect the calculated local future cost.

|

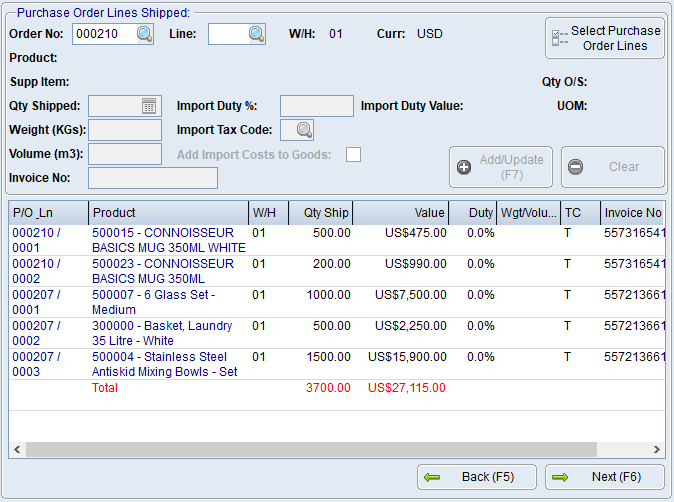

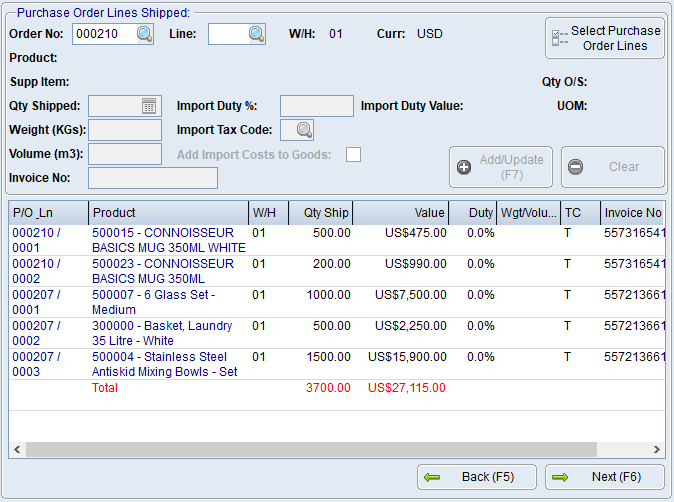

Goods Shipped Tab Goods Shipped Tab

Multiple purchase orders, multiple goods invoices, and multiple warehouses can be added to a single shipment. Entering a PO number will allow the Select Purchase Order Lines button to be used. Once added, multiple items can be highlighted to update the import duty %, import tax code, add import costs to goods flag and/or the invoice number. A purchase order line can be partially received on a shipment (ie if an item ordered is being shipped in multiple parts).

The weight or volume is only required if costing the import via this method. Add import costs to goods can be unticked for items being purchased that aren’t for resale (eg the shipping container the goods are coming in). The import tax code will default to the tax code for the product if it was being bought or sold locally. GST is payable to the customs agent on an import, and this tax code determines if GST on the product will be payable to the customs agent.

Note: All quantities are entered in the units of measure on the purchase order lines. These are converted to the stock units of measure at receipt.

Cost prices cannot be changed on a shipment, these need to be amended on the purchase order prior to receipt.

Where an item is being purchased as part of an overseas purchase that is not for resale (eg a shipping container):

The item should be included as part of the overseas shipment. If required the Add Import Costs to Goods can be unticked so that the value of the expense/asset is not increased by the value of the import costs.

|

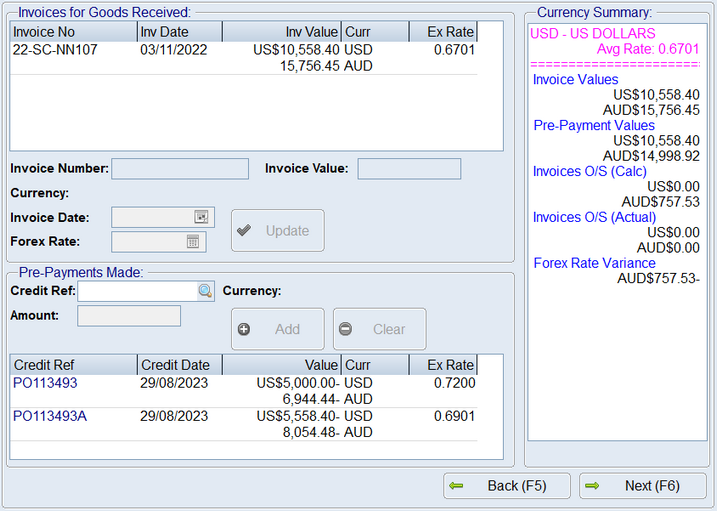

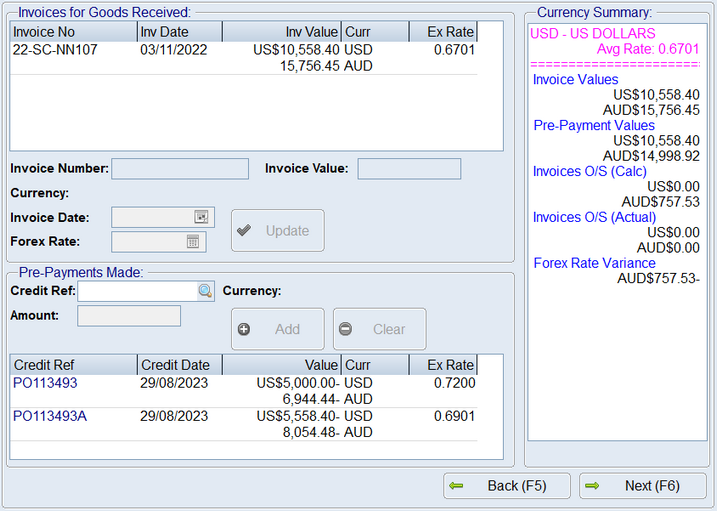

Goods Invoices & Pre-Payments Tab Goods Invoices & Pre-Payments Tab

For each goods invoice number added to the selected purchase order lines, an invoice date and a Forex rate will need to be entered. The Forex rate entered here will be used to value any unpaid amounts of the shipment being received.

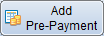

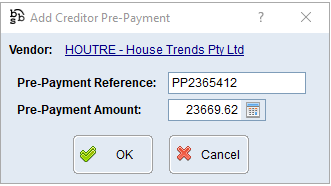

Below this, users can select any prepayments already made for the goods on this shipment. Where exchange rates vary between the goods invoices and the prepayments, a Forex rate variance amount in local currency will be calculated and costed into the goods.

The below example shows two pre-payments in USD that add up to the total of the goods received. All three exchange rates are different. Given that there is no USD amount outstanding, but when you add up the AUD amount they don’t add to zero, the amount of AU$757.53 will be included in the cost of the goods instead of just being journalled off as an expense.

|

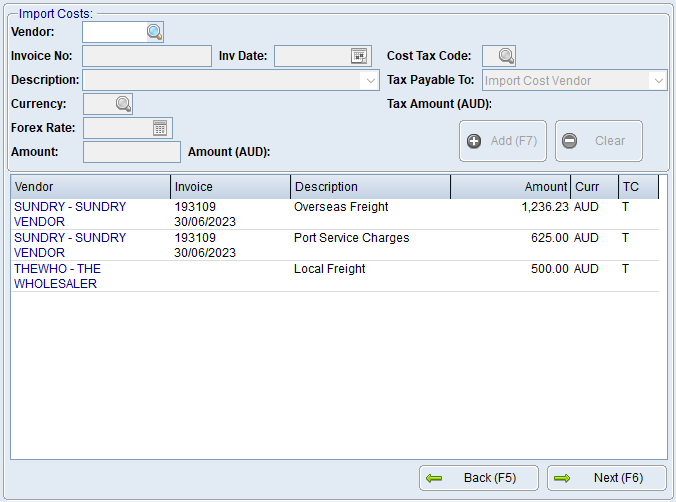

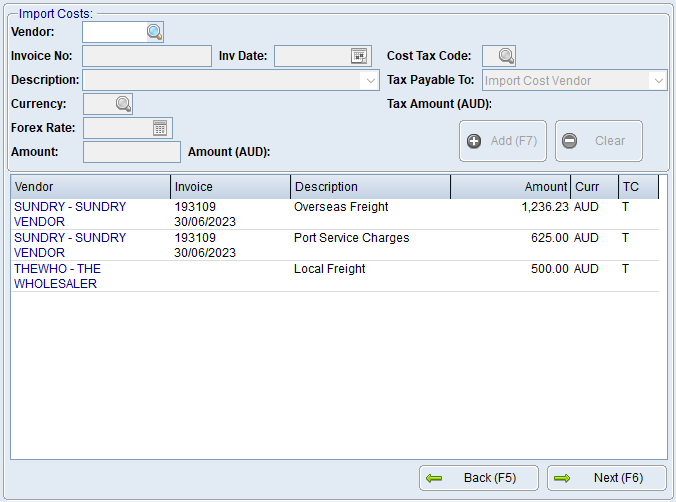

Imports Costs Tab Imports Costs Tab

This is where all the import costs, excluding customs related costs, can be entered. For example, Overseas freight, local freight, port costs etc. If an invoice has been received for the expense the invoice number should be entered so the invoice can be posted to creditors when the shipment is receipted. There is an option to select if the GST is payable to the vendor that is charging the import cost, or if the GST is payable to customs or the customs agent for an import cost.

For example, overseas shipping and insurance are included in the calculation for GST that is payable to customs, however the shipping services may not be supplied by the customs agent themselves. In this case, the shipping and insurance should be added in this tab, but with the Tax Payable To to Customs /Customs Agent instead of to the Import Cost Vendor.

If an import cost is being included as an estimate as an invoice has not yet been received, leave the invoice number blank. This will still post an invoice to the creditor when the goods are receipted, however it can be edited as required when the payable values are known.

|

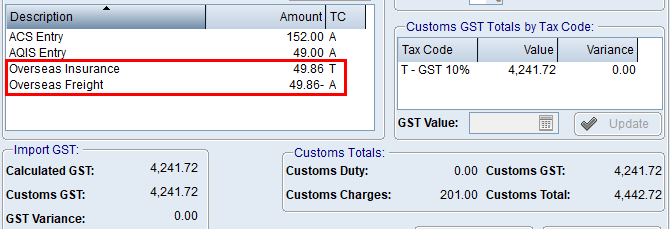

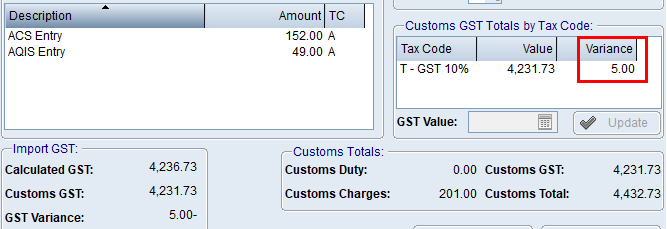

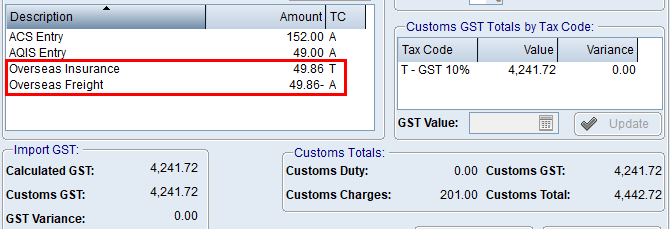

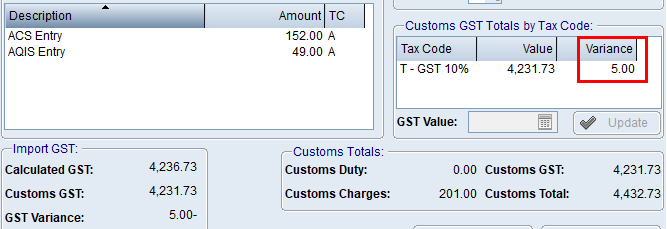

Duty, GST & Custom Charges Tab Duty, GST & Custom Charges Tab

This screen allows the entry of the details on the Customs Entry Document for the shipment. The customs agent vendor is entered, as well as the invoice details for the customs charges. An exchange rate for each foreign currency must be entered based on the customs entry document received for the shipment. This is used to calculate the GST payable to customs for the goods and import costs (where the GST is flagged as customs payable). Additional customs charges can be entered in this screen, as per the customs entry document as well. Users must then confirm the actual duty payable on the customs entry document, the duty tax code (ie if GST applies to the duty), and then GST amounts payable, per tax code, as per the customs entry document. If duty percentages, goods import tax codes and import cost tax codes and settings have been entered correctly, the duty and GST variances should be no more than a few cents. The total displayed as the Customs Total should match the total on the Customs Entry Document.

Where customs charges are estimated and aren't actually payable, but are included in the calculation of the GST payable, users can deal with this situation in two ways.

1.Enter the customs charge with a tax code that calculates GST on the amount and then enter the customs charge again, as a negative, with a tax code that has no GST applied.

or;

2.Do not enter the customs charge and just ensure the GST total for the tax code is correct. This will raise a GST variance amount that will be accounted for in the GST payable anyway as the GST value used is the total the user enters, not the calculated one.

|

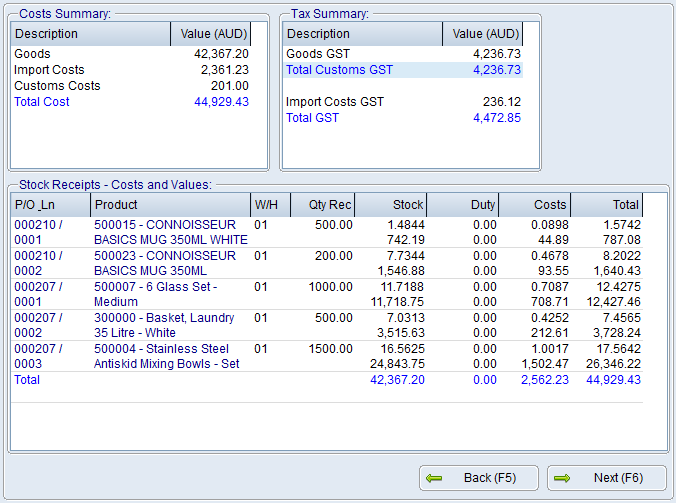

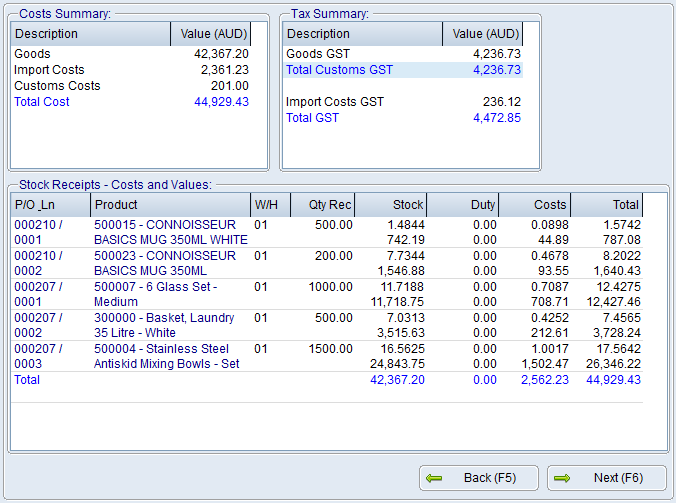

Shipment Summary Tab Shipment Summary Tab

This screen displays a summary of the costing calculation for the goods being receipted, and a tax summary for the GST amounts payable as part of the import. It also displays each item being received and the costs and values calculated that will be used when the goods are receipted.

|

Receipt Stock & Finalise Shipment Tab Receipt Stock & Finalise Shipment Tab

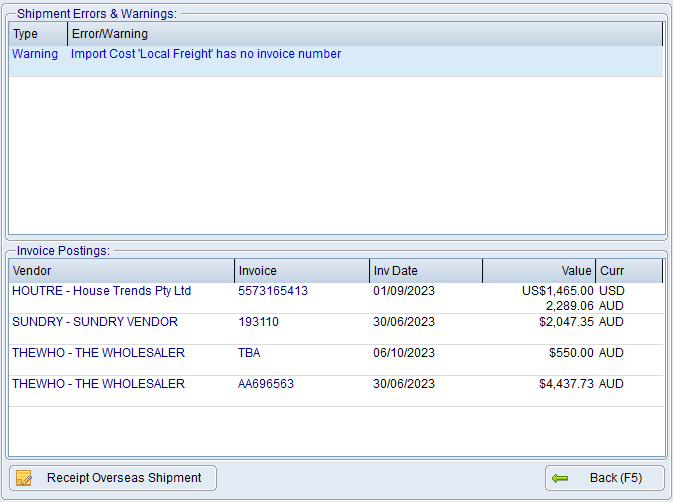

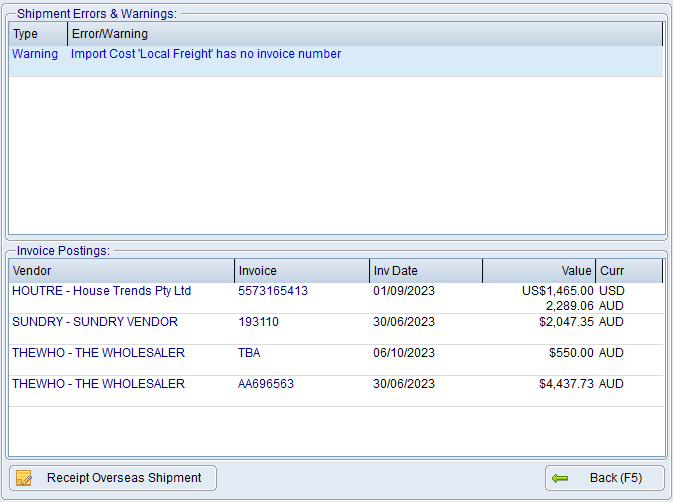

This screen displays any errors or warnings that should be addressed prior to receipting the goods. The goods cannot be receipted if the shipment has an error (usually missing important data), however they can be receipted if there are warnings.

A list of the invoices that will be posted to creditors when the goods are receipted are displayed. Double clicking an invoice number will allow the user to see the G/L postings and values.

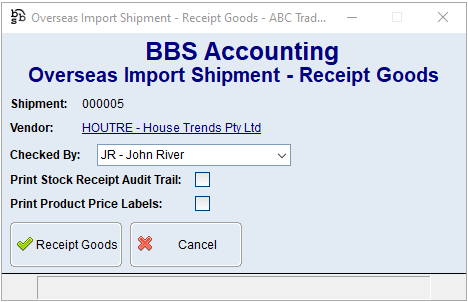

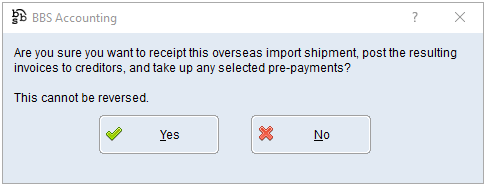

Please refer to Receipting an Overseas Shipment for more information.

|

|

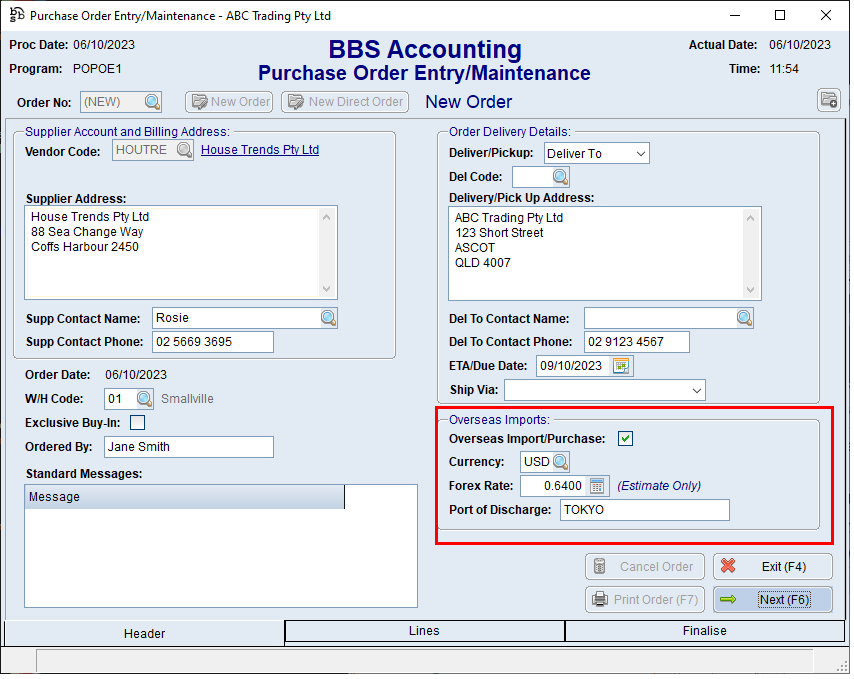

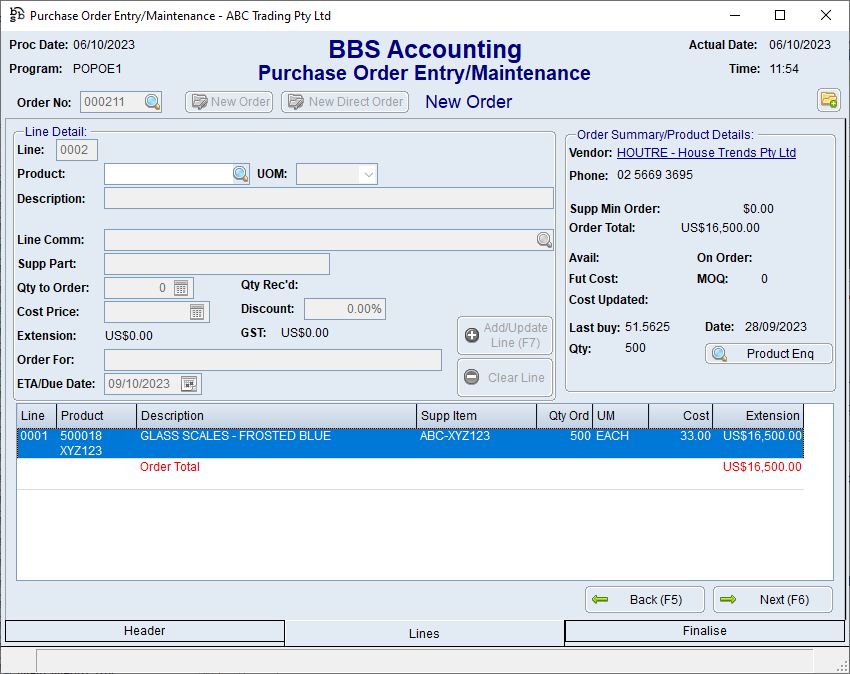

Creating an Overseas Purchase Order

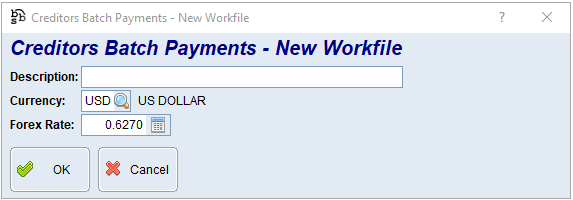

Creating an Overseas Purchase Order Entering Pre-Payments for Overseas Purchases

Entering Pre-Payments for Overseas Purchases Creating an Overseas Import Shipment

Creating an Overseas Import Shipment Receipting an Overseas Import Shipment

Receipting an Overseas Import Shipment