This topic outlines the steps required to prepare your payroll system for SuperStream integration or SAFF file generation.

1.Employee Superannuation Details Check

It is recomended that you run an Employee Masterfile Report/Listing for current employees and check that all employee superannuation funds and superannuation fund member numbers are correct. These can be corrected in Employee Masterfile Maintenance as required.

2.Superannuation Fund Details Check

The Super Fund Maintenance screen has been enhanced to include additional fields that must be filled in for each super fund. These details should be able to be retrieved from your current Superannuation Clearing House, or your employees' Superannuation Standard Choice forms.

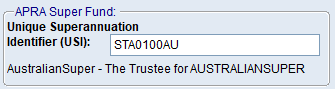

a.For each APRA (standard) superannuation funds, you will need to fill in the Unique Superannuation Identifier (USI).

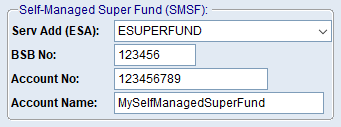

b.For each Self Managed Super Fund (SMSF), you will need to fill in Electronic Service Address and the bank details for the SMFS.

Where multiple employees share the same superannuation fund, but subscribe to different products the super fund offers, there are likely to be different USIs for the different products. In this case, you must create multiple superannuation fund codes in Super Fund Maintenance and link the correct super fund code to the correct employees.

3.SuperStream Sign-Up

If you wish to utilise the SuperStream integration features in BBS Accounting, please fill in the SuperStream Sign-Up form located here, and then scan and return it to us.

Note: Where users opt for a PayTo agreement, a text message or email may be received from your financial institution requesting approval of the PayTo agreement.