This Quick Reference Guide provides details on setting up your system to sell and track gift vouchers, gift cards and store credits. It is divided into four sections: System Setup, Selling Gift Vouchers and Issuing Store Credits, Redeeming Gift Vouchers, Gift Cards and Store Credits, and Gift Voucher Refunds with each section described below.

1. Creating the Clearing Account and the Bank Code: NOTE: Users that already use the Point of Sale Module can skip this step as they already have a clearing account and bank code for transactions against untracked Vouchers.

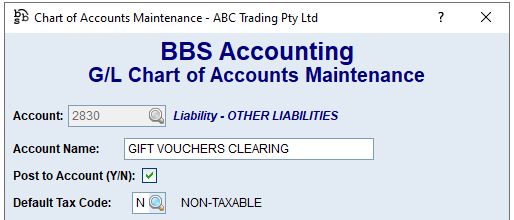

Users should create an ‘OTHER LIABILITY’ G/L account to hold the balance of unclaimed vouchers/store credits. Example:

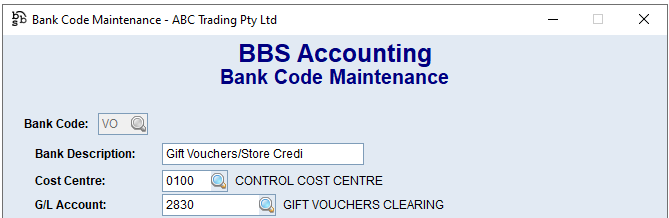

Users will also need to create a Bank Code that can be used to take up payments of vouchers/store credits. This bank code needs to link to the GL clearing account created. Example:

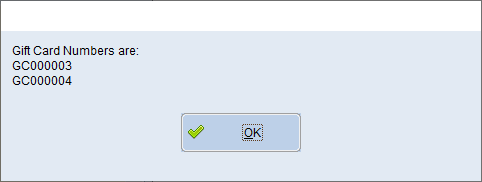

2. Creating Gift Voucher/Store Credit Product Codes for the sale of vouchers/credits: Users can create as many products to sell gift vouchers, gift cards or store credits as they require. For example, if you have pre-printed set value gift cards, each value could be created as it’s own product code.

Create a new product code in Product Masterfile Maintenance.

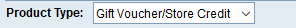

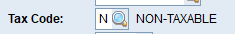

Select the Product Type ‘Gift Voucher/Store Credit’.

Vouchers/credits should be set up as non-taxable (tax code N).

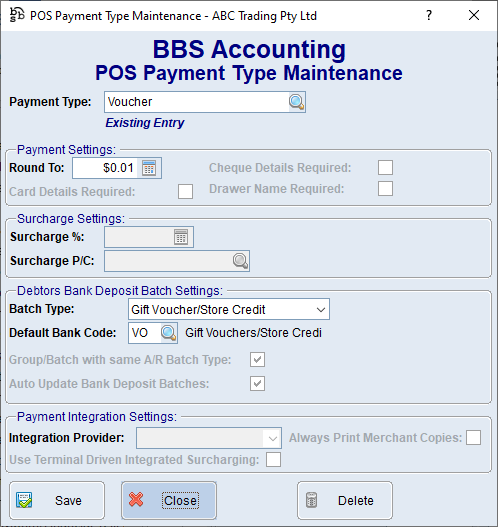

Sell prices can be entered against the product if they have a set value.

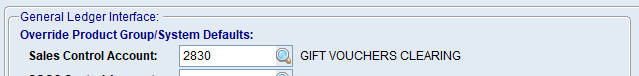

On the more information tab, the Sales Control Account should be set to the Vouchers/Store Credits GL clearing account.

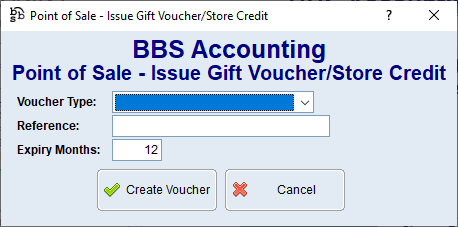

The user must specify the voucher/credit type and enter the number of months the voucher/credit is valid for (leave blank for no expiry date).

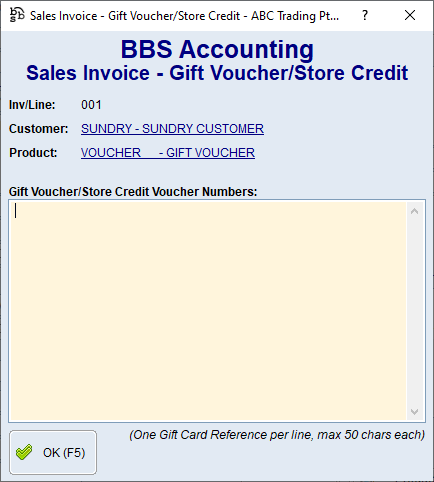

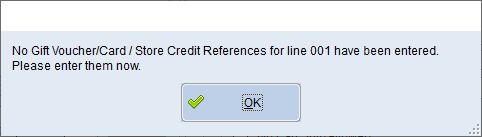

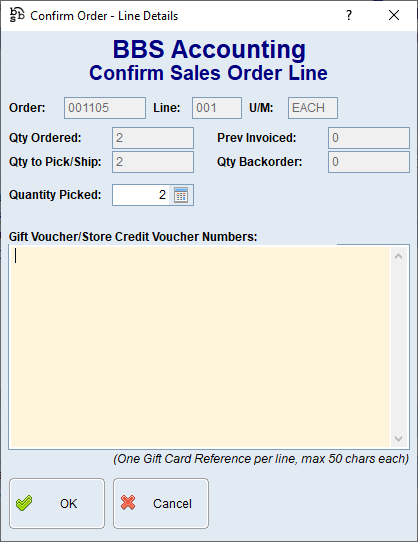

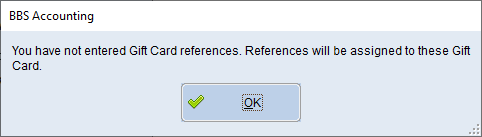

These product codes can then be used to sell customers gift vouchers through the Point of Sale, QuickPOS, Sales Orders and Sales Invoices.

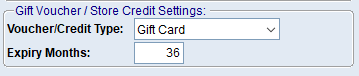

3. Creating the Payment Type for redemption of vouchers/credits: Users will need to create a POS Payment Type for the redemption of vouchers. Users can create multiple payment types if required (eg one for a gift card, and one for store credits), however this isn’t a requirement. This payment type needs to link to the Bank Code for Gift Voucher/Store Credits, and must be selected as Batch Type = Gift Voucher/Store Credit. Example:

|

Selling Gift Vouchers and Issuing Store Credits

Selling Gift Vouchers and Issuing Store Credits

Redeeming Gift Vouchers, Gift Cards and Store Credits

Redeeming Gift Vouchers, Gift Cards and Store Credits

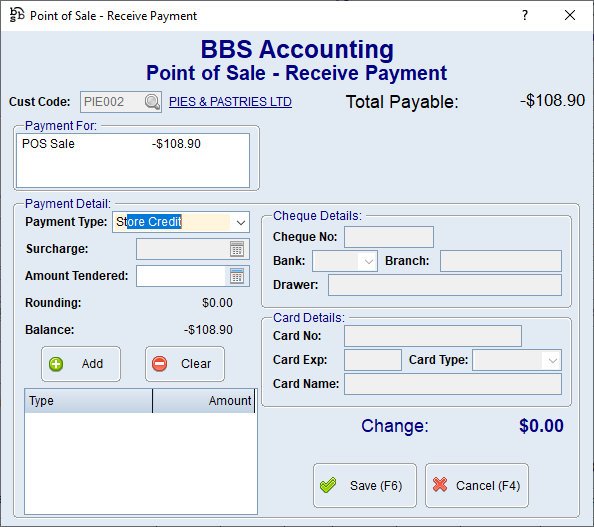

Gift Vouchers, Gift Cards and Store Credits can be redeemed through the Point of Sale and the QuickPOS when processing a payment for a sale, or a payment against a customer in Receive Customer Payments.

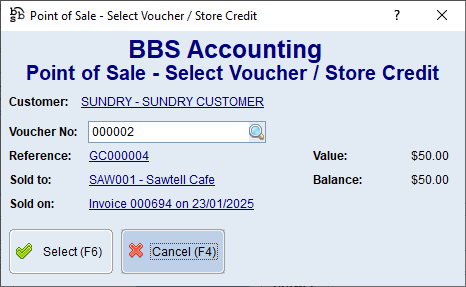

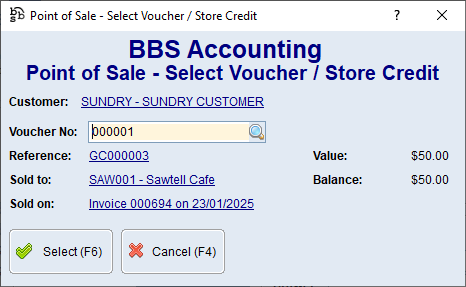

After selecting the payment type for the Gift Voucher, Gift Card or Store Credit a window will pop up to allow users to scan, enter or search for the voucher number or voucher reference.

The payment can then be added to the list and processed.

When redeeming vouchers, the balance is adjusted immediately upon saving the payment transaction. This update happens in real-time, so there is no need to wait until the end of day for the balance to reflect the redemption.

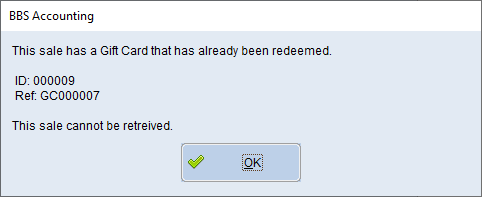

If the payment transaction or the associated POS sale is retrieved and voided, the voucher balance will be restored to its original amount automatically.

This ensures that voucher balances are always up-to-date and accurately reflect any changes made during the transaction process. |

The Point of Sale does not allow for a gift voucher purchased or store credit applied to be returned as a product line item. If it is agreed that a refund should be provided for a gift voucher or store credit, then a refund should be entered through Point of Sale – Receive Customer Payments as follows:

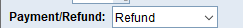

Select refund and enter the customer details

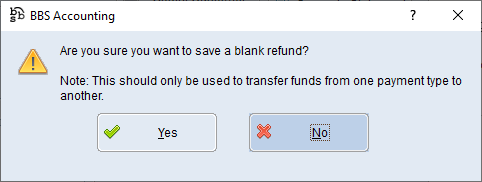

Do not add any items into the refund, click Save Entry:

Answer Yes to save a blank refund.

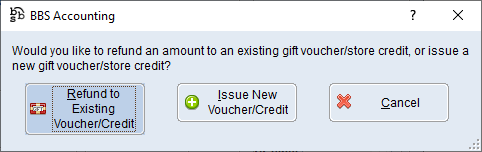

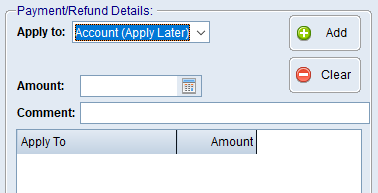

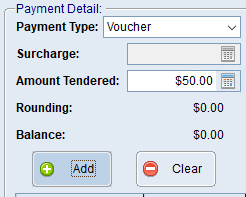

Select the payment type for the voucher/store credit, select the voucher and enter the amount as a positive that is to be refunded. Add the line to the payment.

Select the voucher that is being refunded.

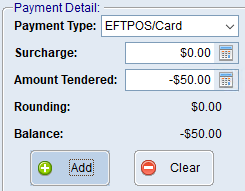

Enter another line on the payment for the method the refund is being provided in (eg Cash/EFTPOS) and enter the same amount as a negative.

Save the transaction. |